Roth Ira Calculator Gov

Eligible tax free distributions include those taken for death or disability after age 59 or for a first time home purchase.

Roth ira calculator gov. Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. 196 000 if filing a joint return or qualifying widow er. After conversion in order to take any distributions that include earnings that are tax free the roth ira must be opened for 5 tax years. Start with your modified agi.

If you satisfy the requirements qualified distributions are tax free. Amount of roth ira contributions that you can make for 2019 internal revenue service. You cannot deduct contributions to a roth ira. Subtract from the amount in 1.

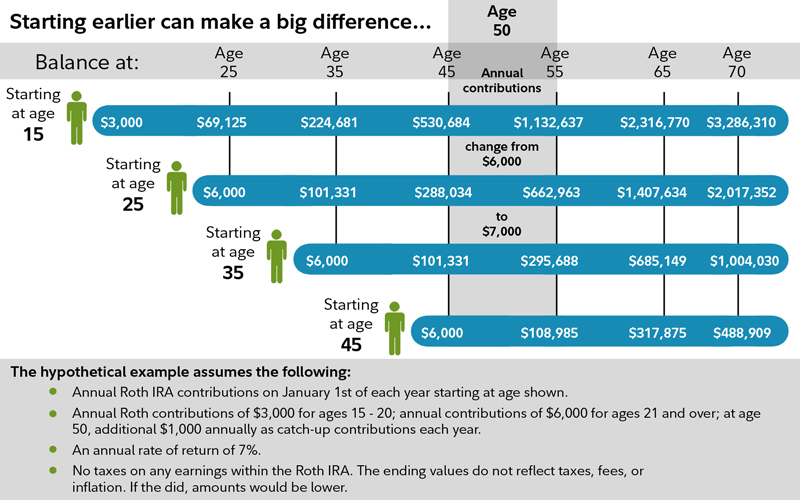

A roth ira is a retirement savings account that allows you to withdraw your money tax free. Amount of your reduced roth ira contribution. Roth ira calculator this is a fixed rate calculator that calculates the balances of roth ira savings and compares them with regular taxable savings. For calculations or more information concerning other types of iras please visit our ira calculator.

You can make contributions to your roth ira after you reach age 70. Amount of roth ira contributions that you can make for 2017 this table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.