Roth Ira Income Limits 2020 Phase Out

Married filing jointly or qualifying widow er 104 000 or less.

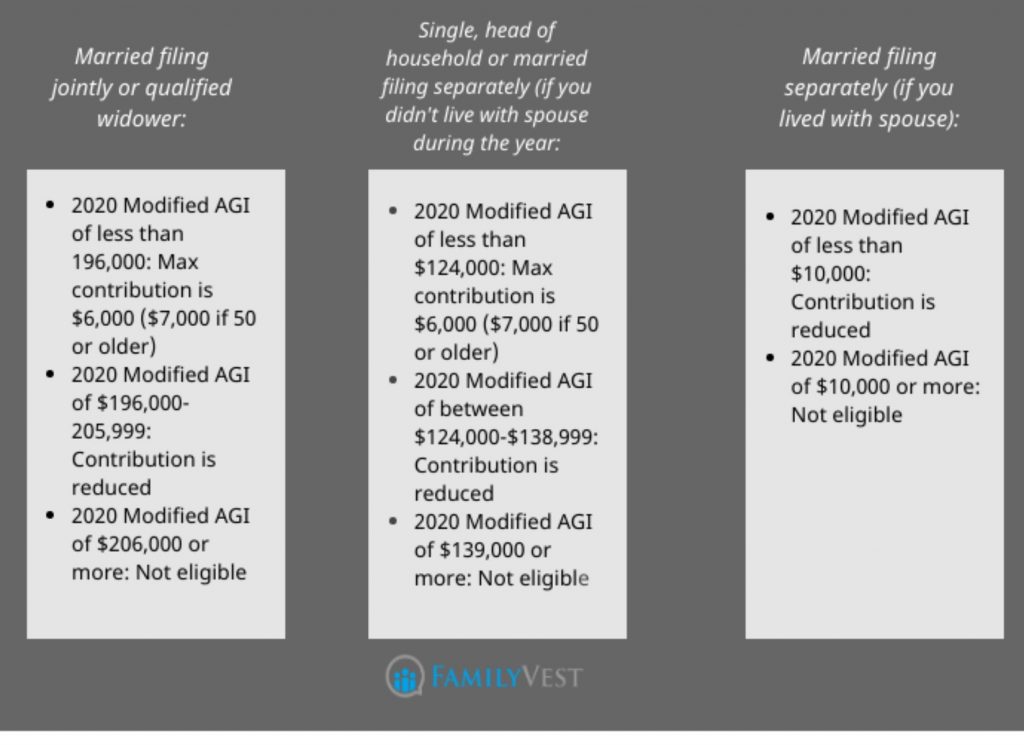

Roth ira income limits 2020 phase out. In 2020 the agi phase out range for taxpayers making contributions to a roth ira is 196 000 to 206 000 for married couples filing jointly up from 193 000 to 203 000 in 2019. The 2020 limit for contributions to roth and traditional iras is 6 000 or 7 000 if you re aged 50 or older remaining unchanged from 2019. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. Subtract from the amount in 1.

196 000 if filing a joint return or qualifying widow er. You can leave amounts in your roth ira as long as you live. You can make contributions to your roth ira after you reach age 70. A full deduction up to the amount of your contribution limit.

Amount of your reduced roth ira contribution. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Start with your modified agi. Married filing jointly or qualifying widow er.

More than 104 000 but less than 124 000 a partial deduction. Amount of roth ira contributions that you can make for 2019. If your agi is below the full contribution limit the center column you can contribute as much as 6 000 to your roth ira in 2020 or 7 000 if you re 50 or older. A full deduction up to the amount of your contribution limit.

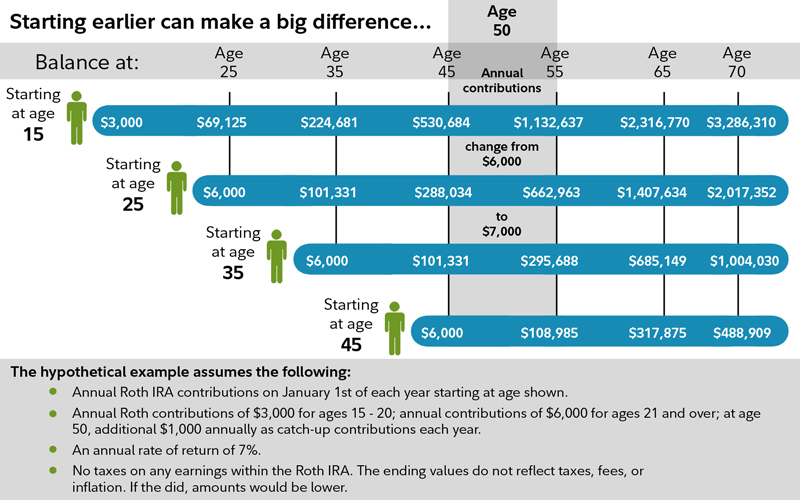

The annual roth ira limit is 6 000 in both 2020 and 2019 up from 5 500 in 2018 if you re 50 or older you can add 1 000 to those amounts. 2019 roth ira income limits. Below we ll look at the new roth ira income limits for 2020 how they ve changed from 2019 s figures and what they mean for you and your retirement savings strategy. But there are restrictions that could affect how much.

The 2019 roth ira income phaseout limits are as follows. The same combined contribution limit applies to all of your roth and traditional iras.